Cover your ears. The GP indemnity timebomb is about to blow

indemnity bomb getty images 177520253 580×750

It is a moment every GP dreads. The yearly letter from their medical defence body that details precisely by how much their indemnity fees are going to rise.

Recently, GPs have reported having to contend with increases of 20%-25%. But a recent change in the law may make even these lofty rises seem like small fry.

Recent government changes to the so-called ‘discount rate’ mean victims may receive double the amount in compensation, resulting in even more terrifying indemnity premiums.

Since a change in law in January, there has been a stand-off between the Department of Health and the medical defence organisations. The MDOs say they are holding off increasing their fees while they wait for the Government to provide additional funding for GPs. But ministers say they are waiting until the fee rises are announced before deciding what support they will provide.

But this situation cannot continue, with costs expected to be passed on this autumn. And when the GPs caught in the middle of this stand-off finally get their bills, they are likely to be eye-watering. The BMA’s GP Committee has gone as far as to say they could make general practice ‘untenable’.

Urgent talks are continuing behind the scenes between the GPC, the DH and the MDOs in search of a solution that will remove any additional burden on GPs.

A DH spokesperson tells Pulse: ‘The Department of Health will work closely with GPs and medical defence organisations to ensure that appropriate funding is available to meet additional costs to GPs, recognising the crucial role they play in the delivery of NHS care.’

But these words won’t provide much comfort for GPs. They’ve heard it all before. After all, this won’t be the first time they’ve been hit by soaring indemnity costs, even though the profession is practising more safely than ever.

‘I am limiting my in-hours sessions per week as I don’t want to breach the bracket of sessions I’m in’

Dr Tim McMinn, GP in Brighton

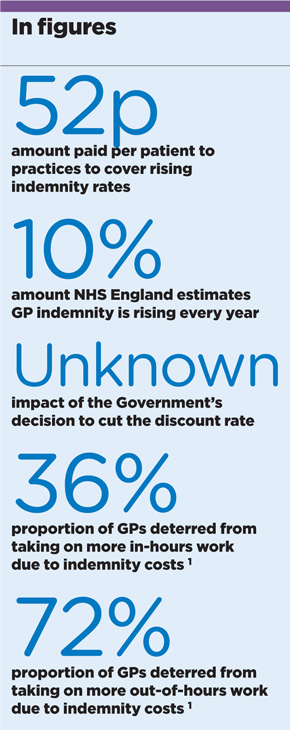

NHS England’s own survey data show a third of GPs are put off working in-hours, and 72% out of hours because of indemnity costs. Its solution was a blanket payment of 52p per patient to cover what managers estimated was a 10% increase in fees last year. But for many GPs, this has barely touched the sides. To start with, the 10% figure is well below the actual increases faced by some. According to BMA sessional GP subcommittee member and Blackburn GP Dr Preeti Shukla, GPs are reporting rises of ‘anything between 20-25% – sometimes even 35%’.

‘Fee hikes are killing my profession,’ Dr Shukla writes in an open letter to the health secretary.

In addition, the money was paid directly into the global sum. So, for many partners, this has simply been swallowed up by the gaps in practice finances caused by years of below-inflation funding increases, rather than going straight to pay their individual indemnity increases. For sessional doctors paying their own indemnity, the arrangement has been particularly unfair as there is no compulsion for practices to pass on the funding they received.

indemnity in figures sept2017 290x730px (2)

NHS England has a bold aim, saying in the GP Forward View last year that GPs should be ‘no more exposed to the rising costs of indemnity than hospital doctors’.

But it’s unclear how it will achieve this. The MDOs’ preferred option would be to tackle the rising cost of claims at source. The DH has conducted a consultation into fixing the amounts lawyers can claim in fees for cases involving compensation claims up to £25,000 but ministers have yet to respond to it; in any case, the MDOs suggest the consultation’s remit prevents it from bringing in the reforms required. A recent MPS report proposed setting limits for fixed costs far higher, to include claims up to £250,000.

Another way to ensure GPs are no more exposed than secondary care colleagues is for them to pool their risk and be protected from the vagaries of the insurance market under a collective, NHS-run scheme. Trusts, who pay their staff’s indemnity costs, have their risks pooled through the NHS Litigation Authority, which prevents them from facing sky-high costs.

A recent survey by the MDU of 900 GPs found nine out of 10 would like to be covered under an NHS indemnity scheme. And this has been implemented successfully for out-of-hours GP work in Wales since 2014, when the Government started funding the Welsh Risk Pool Services mutual organisation to reimburse losses over £25,000 incurred by out-of-hours GPs for negligence claims. The Welsh GPC reports that GPs are more willing to take on out-of-hours shifts as a result.

Read our full coverage on indemnity

‘GP indemnity fees are killing my profession’

What GPs are saying about the indemnity ‘timebomb’

It’s time to discuss how much we earn

GP winter indemnity scheme to be repeated in absence of long-term solution

NHS England: ‘Why we are paying out-of-hours indemnity costs this winter’

NHS England advisor Sir Sam Everington recently told Pulse’s sister title Healthcare Leader the profession should go back to a previous system that saw all GPs sharing risks equally.

He said: ‘This was based on the total national payouts each year. Why did we allow this to change?’

This is something that NHS England has considered. Its review last year looked at transferring all GP indemnity to a scheme similar to that run for trusts, but concluded: ‘The complexities involved in this kind of scheme are immense… it would not itself be a more efficient way of meeting the indemnity bill, or of reducing the total amount of money needed to cover the risk.’

But even if such a scheme were to be implemented, it wouldn’t create parity between GPs and hospital doctors, as practices would still have to pay all the costs. One solution to achieve fairness is that proposed by this May’s LMCs Conference – which sets GPC’s policy for the year – calling for the ‘full reimbursement of all indemnity costs’.

As GPC workforce lead Dr Krishna Kasaraneni told the conference: ‘The point about complete reimbursement of costs is this is the only way this problem can be solved. Unless we get an equivalent arrangement for indemnity reimbursement as we have with the CQC [fees reimbursed in full] we will struggle next year to keep our surgeries open.’

NHS England tried this approach for out-of-hours GPs over the past two winters and it worked wonders. In 2015/16, it brought 15,000 additional shifts.

Full reimbursement of all GP premiums would cost the Government dear, but may be the only short-term solution that allows GPs to continue working. As for the longer term, there is another solution on the horizon – but perhaps not one that will appeal to grassroots GPs.

New contracts springing up across the country are offering indemnity deals for GPs who are willing to go salaried under larger organisations – either NHS England’s ‘new models of care’, the local trust or on a federation-wide basis.

Of course this points to a salaried future for general practice, something many abhor. But if crippling indemnity rises continue, the profession may be left with little choice.

Why are indemnity fees rising?

Indemnity premiums for GPs are rising in response to: patients making more clinical negligence claims, encouraged by ‘aggressive’ personal injury claims companies and a more litigious culture; the increasing value of payouts due to patients living longer and so claiming compensation over a longer period; and the increasing costs of the legal process.

There are differences in fees across the UK, although rises are seen across the country. The MDDUS says GPs in England are ‘three times’ more likely to be hit with a negligence claim than those in Scotland, where patients are less litigious. Northern Ireland GPs are also less likely to be sued than their English counterparts, which is reflected in reduced subscription fees. The English legal system is also problematic in the sense that it allows for ‘runaway’ costs, with no limit on how much the losing side may have to pay for fees relating to expert witnesses and the winning party’s legal costs.

But by far the biggest factor in recent years is the Government’s change to the ‘discount rate’. This is a calculation courts apply to lump-sum compensation payouts when victims have suffered life-changing injuries. It is related to how much interest they can expect to earn by investing the sum at the lowest risk. Now this discount rate has been cut from 2.5% to minus 0.75%, payouts will have to rise accordingly.

It is not yet clear how much this will add to fees, but MDOs say some payouts could double. This will filter into GPs’ costs over the coming months.

Pulse July survey

Take our July 2025 survey to potentially win £1.000 worth of tokens