As all GPs are aware, the indemnity crisis is spiralling out of control. Indemnity costs have been rising dramatically over the last few years, which has led to some GPs dropping expensive out of hours work and therefore a recruitment crisis for out of hours providers.

Anu is a GP who annually spends several days toing and froing and obtaining quotes from MDOs in order to get the best indemnity deal. This is a frustrating process which raises many questions. Here are a few important questions that we couldn’t find answers to, which we are sure many other GPs share:

- How do you know if you’re paying too much for your medical indemnity?

- If you want to switch, who is best to get a quote from?

- Is there a quicker way to get quotes without tedious forms or spending vast amounts of time on the phone with insurers?

- Some people seem to always get the best deals, how do you get inside information and why isn’t it all transparent?

How can we solve the indemnity crisis if we don’t have the answers to these questions? After extensive discussions with a broad range of experts, we found that we could answer these questions if we worked together to compare indemnity costs.

Hence, indemi was born.

What does indemi currently offer?

After filling out a two minute form, registered GPs can see what indemi members of similar risk pay for indemnity. As more members join, the risk groups are refined giving you more and more information. This will hopefully allow GPs to:

1. Immediately know how your price stacks up: You get an instant indication of how much you’re paying compared to your similar peers. Everything is visual and transparent, with the ‘price barometer’, showing green for a low and red for high.

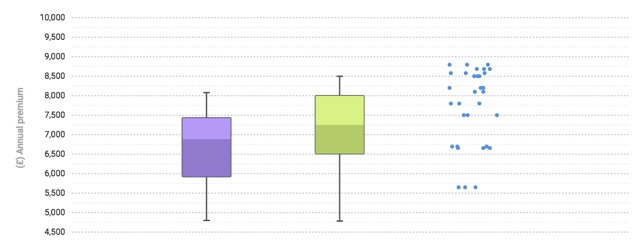

2. Find the best deal for your risk: If you’re interested in switching, you can instantly see which MDOs are usually best for your type of risk. The ‘box and whisker’ graph shows you which MDO could get you a better quote. You can also ‘explode boxes’ to see the fully transparent method for constructing these graphs and how you compare.

The more members we have, the more accurate the grouping and narrower the spreads. Our testing revealed an average saving of £1,000 per GP.

3. Get the tips and tricks: You get access to the inside info and tricks from your peers on how to get a better deal. You can see how others get better deals at the moment (and we have seen all sorts of ways to cut indemnity costs) and you can add tips to help your fellow GPs.

Indemi undertakes the highest level of data security available currently and will continue to do so at a high level (HIPAA compliance level). Identifiable data is not shared with any parties whatsoever. Non-identifiable data, particularly aggregated crunched data will be used for the goals outlined below.

What is our goal?

To rapidly assist the indemnity crisis with data visualisation and aggregated risk data. We aim to do this in three ways.

1. Short Term – Price Comparison. Provide every GP quick access to information regarding which MDO has best price for their risk criteria to save money.

2. Medium Term – Indemnity Efficiencies. The MDOs provide an excellent service and indemi supports these mutuals. Members switching will enable MDOs to focus on value and customer experience for the risk segments they service the best. Legal changes coming soon which will set criteria for the quality and boundaries of any new entrant (and current) medical indemnity offering. Indemi is considering assisting new entrants to the market, for example by setting criteria for the high quality and a broad scope of new offerings.

3. Long Term – Risk Reduction. Work with key stakeholders – NHS, BMA, MDOs and other insurers, to use aggregated and entirely anonymised data to work out how to reduce risk and solve the escalating indemnity payout crisis. The data can help to find ways to reduce the global risk. For example, risk data helped enable the hybrid NHS crown indemnity cover for OOH GP services in Wales.

We aim to develop more services that help the professional and personal lives of medics. The comparison tool will always remain free to use for all doctors and indemi currently does not make money from it. We see our additional services providing added value to members which in turn may provide revenue via third parties to sustain the service.

With our data, real solutions can be formulated and deployed to ensure fairness to doctors and enable doctors to carry out certain roles (e.g. OOH) thus bolstering service provision. We hope we can make a significant and positive impact on the current indemnity issues.

Pulse October survey

Take our July 2025 survey to potentially win £1.000 worth of tokens