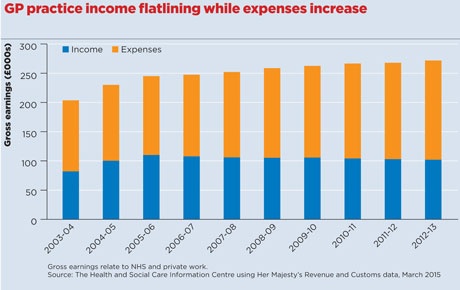

For the eighth time in nine years, it is likely that GPs will see a reduction in take-home earnings – but this year could be the worst of the lot.

The 1.16% funding uplift announced by Government, far from achieving the intended 1% take-home pay increase for GPs, is likely to be wiped out quickly by increases in expenses.

In what GPs see as yet another kick in the teeth, the Government calculated the award using a formula discredited by the GPC and abandoned by the independent pay review body itself.

As a result, accountants warn this could effectively translate into an unprecedented pay cut of up to 10% for GPs.

GPs are warning that they can no longer put off staff pay rises, having been forced to do so by previous pay awards.

Others say this may leave them with no choice but to cut back on services, or even push them closer to the precipice of closure.

This is despite NHS England saying it ‘wants a new deal’ for general practice in its five-year plan, and the health secretary repeatedly saying he wants to shift funding towards general practice.

Last month, Earl Howe referred to the ‘strong economy’ that has allowed the Government to grant GPs a pay rise of 1%, in line with the recommendation by the Review Body on Doctors’ and Dentists’ Remuneration (DDRB).

But to calculate what level of award was needed to deliver a 1% pay increase, the Department of Health used a funding formula that the DDRB itself had stopped using this year as it had failed to deliver previous pay increases, resulting in only 0.16% being given to cover practice expenses from April.

This fed into an overall uplift to the global sum of 3% in England – although much of this will be paid for by cutting other forms of funding such as MPIG and discontinued DESs, leaving winners and losers. As Pulse went to press, the funding uplift for practices in Scotland, Wales and Northern Ireland were yet to be announced.

GPC chair Dr Chaand Nagpaul says the pay award will not address the ‘extreme pressures’ affecting general practice.

Family Doctor Association chair, Dr Peter Swinyard, is even more damning.

He says: ‘The “pay rise” will do nothing for recruitment or retention, especially for partners – it is undoubtedly a major pay cut after expenses rise inexorably. I regret that this short-sighted settlement will not satisfy the need for an increase in GP provision nor stop the closure of practices at risk.’

Accountants immediately said the award would in effect mean a pay cut for GP partners of up to 10%.

Mike Ogilvie, client services director at OBC The Accountants, says his clients would definitely see sizeable a pay cut in the year to come, as many were choosing to award their staff a 2% rise this year – well deserved after years of pay squeezes. He says: ‘GPs are being very careful on their costs [but] their income is also being squeezed so they will be anticipating probably a 10% or more reduction in take-home pay for next year.’

He adds that a lot of staff wages have been ‘kept down in past years’, but adds: ‘As with so many other people in business, there’s only so long you can keep staff without increasing pay.’

Related articles

Accountant’s view: ‘Any gains from 2004 have been eroded’

Keith Taylor, head of medical services at BW Medical Accountants, says that, after expenses, the funding uplift will only result in a pre-tax funding increase of £700 per partner, or 30p per patient – ‘hardly a significant increase’.

Partners feel they have no choice but to give staff pay rises – even though these will be at the expense of the partners themselves. Dr Joe McGilligan, a GP in Redhill, Surrey, and a former chair of NHS East Surrey CCG, says he expects to be out of pocket: ‘As partners who value our staff, we pass on the uplift to them at our expense.’

Ipswich GP Dr Sally Whale says the partners at her practice will ‘probably take the hit to ensure our staff get the rise they deserve as we can’t do the job without them’.

The DDRB acknowledges that GPs have suffered pay decreases over the past few years, with only 2009/10 providing an increase – and that was only 0.4%.

Its report, which recommended the 1% pay rise, but stopped short of proposing how this should be achieved, said GP earnings had fallen far short of the intended increase in each of the five years for which it had made a recommendation. In 2011/12, it had intended GPs to receive a 1.5% pay increase. However, the 1.4% recommended funding uplift actually led to a 1.5% decrease in take-home pay.

This latest award comes at a time when partners’ pensions contributions have increased, while a cut in pensions tax relief, announced in the Budget, will also hit them in the pocket.

Dr Nagpaul says that while the GPC has not yet formally worked out what the 1.16% funding uplift will mean, he is concerned about its implications for struggling practices. But he says practices can mitigate loss of earnings.

He pointed to the GPC’s guidance on managing workload from January this year, saying: ‘We have to cut our cloth according to what we are awarded. There are many things we don’t need to do; there are many expenses that we take on from work we don’t have to do. We do have choices about how we manage our expenses and our workload.’

But Dr Whale is unconvinced. She says: ‘We have already pared as much as we can without damaging the service beyond repair in terms for efficiencies.’

And she’s not alone. Nottinghamshire GP, Dr Tony Brownson, says costs involved with CQC inspection and locum cover are among the many rising expenses practices are having to shoulder.

He speaks for many GPs when he says: ‘I’m not sure why anyone would take a full-time job, let alone a partnership, when they could be earning more with no responsibility beyond the patient sitting in front of them.

‘Retirement is very attractive.’

Pulse October survey

Take our July 2025 survey to potentially win £1.000 worth of tokens