From red to black: Private sector profiting as NHS crumbles

nhs in distress 3×2

‘No extra cash,’ was reportedly the message from Prime Minister Theresa May to the NHS at a recent private meeting.

It seems the Conservative austerity programme will continue, despite lengthening waiting lists, greater rationing and mounting concern over how the NHS will get through the winter.

In contrast, a special investigation by Pulse shows private healthcare in the UK is buoyant.

Pulse has learned major healthcare companies are seeing profits more than double, uniformly citing the pressures on the NHS as the driver for increased activity. But the companies benefiting are not the usual suspects, like Virgin Care and Care UK, who rely on winning contracts to run large parts of the NHS.

Instead, it’s those companies offering an alternative to the decrepit NHS that are cashing in. Private hospitals are capitalising on the underfunding of the NHS by expanding their services, focusing on areas subject to rationing drives or long waiting lists – such as cataract treatment and hernia repair.

A recent survey of private healthcare industry leaders concluded the ‘self-pay’ market could grow by 10-15% a year over the next three years.(1) Tellingly, it singled out falling confidence in the NHS among the public as a major driver of business.

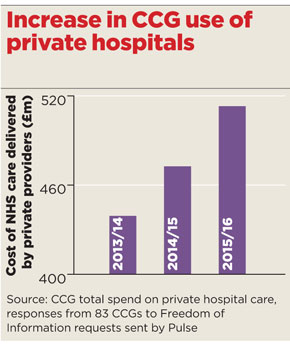

Meanwhile, figures obtained by Pulse under the Freedom of Information Act reveal many CCGs are expanding the use of the private sector to reduce waiting lists, with commissioning of care from private hospitals growing by 18% between 2013/14 and 2015/16.

nov2016 private hospitals 290×344

And GPs in one area were recently asked to encourage their patients to use their private health insurance if they have it. The reason? CCGs’ desperation to make savings. The policy was a success, of sorts. NHS Mid Essex CCG reported GP referrals to private providers increased by 6%, perhaps providing a measure of relief to stretched NHS services.

But this short-term gain provided a window on the future direction of the health service – one where the NHS is shrinking, while private healthcare continues to expand.

And general practice services themselves are next in line for the private sector; in the past year a raft of private GP outfits have burst onto the scene, with many explicitly citing the crisis in general practice to promote their self-pay services.

They include app developers, who match up patients and GPs offering private sessions, and others who offer the chance to speak to GPs over a video link. Larger private providers are also showing interest in general practice.

GP leaders say the Government is undermining the NHS in favour of the private sector through ‘scandalous’ underfunding, and ‘sleepwalking’ us towards a US-style health insurance system.

And private companies’ own figures seem to back this up. BMI Healthcare says it more than doubled its profits last year, reporting a 2.3% overall increase in inpatient and day cases, and a 13.5% rise in its NHS caseload, ‘with waiting list pressure and patient choice driving the increase’.(4)

In August, BMI announced a new ‘general medical admissions service’, which will enable GPs to refer patients quickly for private treatment for a ‘broad range of conditions and illnesses’. The company’s lead for the new service Wouter Van Den Brande tells Pulse it has been introduced in response to the ‘many enquiries received from our patients… who want a viable alternative to queuing to get into an NHS site’.

Meanwhile, Spire, which runs a network of 38 private hospitals, has seen revenue and patient volumes increase by 30% and 20% respectively in the past five years, and expects to see this trend continue. Its 2015 annual report2 cites the ‘NHS funding gap’ as a key driver and says that, with funding constraints forecast to continue, ‘the independent sector can help to bridge the gap’.

Related articles

Investigation: Private sector profits as NHS crumbles

How private GP services are expanding

Private companies see profits double while NHS waiting lists increase

CCGs spending hundreds of millions more on private sector treatment

Trusts earn millions through private work while facing remedial action

Interestingly, Care UK and Virgin Care – which rely on winning contracts to deliver services in the community – have seen revenues fall, while UnitingCare pulled out of an £800m contract in Cambridgeshire after just eight months, complaining the arrangement was ‘financially unsustainable’.

The companies booming are the ones taking advantage of long waiting lists at NHS providers. There has been an 18% overall increase in the amount spent on NHS care delivered at private hospitals over the past three years – a hike that followed the new competition regulations under the 2012 Health and Social Care Act.

nov2016 private patients 290×344

NHS Walsall CCG, for example, has seen a 175% jump in spend on privately delivered care, from £1.6m to £4.4m, after it was forced to take ‘remedial action’ under NHS England direction to clear a backlog of operations at the local acute trust. Paul Maubach, accountable officer at the CCG, explains the main reason for the rise was ‘the significant pressure on our local trust to meet its constitutional referral-to-treatment targets to treat patients within 18 weeks’.

Others cite waiting list pressures. NHS Horsham and Mid Sussex CCG increased its spend on private providers doing elective care by 80%, from £800,000 in 2013/14 to £1.5m in 2015/16.

CCG chair Dr Minesh Patel puts this down to ‘GPs wanting to ensure timely care for patients as well as supporting the local acute provider to manage its own activity levels’.

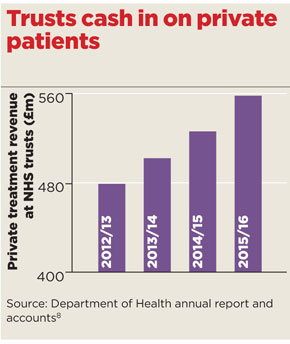

Alongside as the introduction of the new competition rules for CCGs in 2013, the cap on the amount hospitals could make from private care was lifted from 2% to 49%. This has led to the perverse situation that extra capacity in trusts is being used for private care, while 3.7 million NHS patients wait for treatment – the most since December 2007.

At the same time, trusts across England saw a 14% increase in income from private patients between 2012/13 to 2015/16.

They say they are doing this to raise revenue for NHS activities. Pulse can reveal Royal Brompton and Harefield NHS Foundation Trust brought in £39.3m in private income in 2015/16 – a 36% increase on 2012/13 – at a time when it is going through remedial action for missing waiting time targets. A spokesperson tells Pulse: ‘As pressures on NHS funding continue, this revenue stream becomes increasingly important.’

Meanwhile, Poole Hospital NHS Foundation Trust, in Dorset, increased its private revenue by 83% between 2012/13 and 2015/16. It is now broadening its private services to include a range of surgical, oncological, diagnostic and outpatient tests. A statement from the trust says: ‘All the income is reinvested into the hospital to support the care of NHS patients – which is extremely useful in the current financial climate.’

Cherry-picking

But GPC chair Dr Chaand Nagpaul says the rise in private use ‘represents a clear diversion of funds out of the NHS and into the private sector’.

Dr Nagpaul says: ‘In many cases private providers will cherry-pick low-risk patients, adding further strain onto impoverished NHS hospitals caring for patients with greater morbidity. This is unfairly undermining the NHS in favour of the private sector.’

BMA council member and former RCGP chair Professor Clare Gerada, who led much of the opposition to the 2012 reforms, is even more pessimistic.

She believes the situation will lead to a ‘multi-tier system’ where those with the means ‘buy what we see now as “normal” GPs’, while others rely on services ‘scrambling for money from the state, charitable, academic and business sectors’.

Professor Gerada adds an ominous warning: ‘I am afraid that we are sleepwalking into US health system.’

But the Department of Health has continued to highlight the £10bn invested by former chancellor George Osborne into the NHS. A spokesperson says: ‘This Government was the first to ensure that doctors, not politicians, make decisions about who provides care. In fact, the rate of growth in use of the private sector as a proportion of the NHS budget remains slower than it was before 2010.

‘On the back of a strong economy, we are giving the NHS the £10bn it asked for to fund its own plan for the future.’

In the grand scheme of things, the slice of NHS money going into the private sector, although rising, remains low, at 7.6%. But this doesn’t take into account the hidden privatisation occurring as patients look at long NHS waiting lists and decide to go elsewhere. While the NHS is having to cut its coat according to the shrinking cloth on offer, private companies can expect to continue the boom of recent years.

References

1 Private Healthcare UK. Self-Pay Market Study 2016.

2 Spire Healthcare Group. Annual report 2015. tinyurl.com/2015-spire

3 Nuffield Health. Annual report 2015. tinyurl.com/2015-nuffield

4 Netcare Limited, Summarised audited group results 2015. tinyurl.com/2015-netcare.

5 Circle UK Annual report 2015

6 Care UK. Annual report 2015.

7 Virgin Care. Full accounts, March 2015.

8 Department of Health. Annual report and accounts.

Pulse October survey

Take our July 2025 survey to potentially win £1.000 worth of tokens